How Marketing Strategies Influence Stock Prices

Stock prices reflect more than quarterly earnings and balance sheets. Marketing strategies play a crucial role in shaping investor confidence and driving brand-driven valuations. Understanding this connection can help executives make strategic decisions that benefit both customers and shareholders.

The relationship between marketing and stock performance has become increasingly evident as companies like Tesla, Apple, and Nike demonstrate how strong brand strategies translate into market premiums. Their success reveals that effective marketing doesn’t just drive sales—it creates intangible value that investors recognize and reward.

This post examines how different marketing approaches impact stock valuations, the mechanisms behind brand-driven pricing, and strategies companies can use to build market value through marketing excellence.

The Connection Between Marketing and Market Value

Brand Equity as Financial Asset

Marketing creates brand equity, which represents the financial value derived from consumer perception and loyalty. Companies with strong brand equity command premium valuations because investors understand that established brands generate more predictable revenue streams and face less competitive pressure.

Brand equity manifests in several measurable ways that directly impact stock prices. Strong brands typically enjoy higher profit margins, greater customer lifetime value, and more resilient market positions during economic downturns. These factors translate into lower perceived risk and higher expected returns for investors.

Market Sentiment and Perception

Marketing campaigns influence how investors perceive a company’s future prospects. Successful product launches, brand partnerships, and marketing initiatives often coincide with stock price increases as investors interpret these activities as signals of future growth potential.

The market responds particularly strongly to marketing strategies that demonstrate innovation, market expansion, or competitive advantage. When companies successfully communicate their strategic vision through marketing, they often see positive reactions from both consumers and investors.

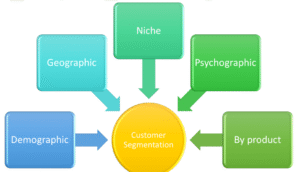

Types of Marketing Strategies That Drive Stock Performance

Innovation-Focused Marketing

Companies that position themselves as innovation leaders through their marketing often receive premium valuations. Tesla’s marketing strategy, which emphasizes technological advancement and environmental sustainability, has contributed to its high price-to-earnings ratio compared to traditional automakers.

Innovation-focused marketing works because it suggests future growth potential and competitive advantages. When companies successfully communicate their innovative capabilities, investors often reward them with higher valuations based on expected future returns rather than current performance alone.

Brand Building and Emotional Connection

Marketing strategies that build strong emotional connections with consumers create sustainable competitive advantages that investors value. Apple’s marketing approach, which emphasizes design, user experience, and lifestyle integration, has contributed to its position as one of the world’s most valuable companies.

Emotional brand connections translate into customer loyalty, reduced price sensitivity, and stronger market positions. These factors create predictable revenue streams and defensive market positions that investors recognize as valuable assets.

Market Expansion Strategies

Marketing campaigns that successfully expand into new markets or demographic segments often drive stock price increases. Investors view market expansion as a path to revenue growth and increased market share.

The key is demonstrating not just market entry but sustainable competitive positioning. Companies that show they can successfully adapt their marketing to new markets while maintaining brand consistency often see positive investor responses.

The Psychology of Investor Response to Marketing

Confidence and Future Expectations

Marketing success signals to investors that a company understands its market and can execute strategic initiatives effectively. This confidence in management capabilities often translates into higher stock valuations as investors become more optimistic about future performance.

Strong marketing execution demonstrates operational competence across multiple business functions. Investors recognize that companies capable of building strong brands typically have effective leadership, clear strategic vision, and strong execution capabilities.

Risk Perception and Brand Moats

Established brands created through effective marketing represent competitive moats that reduce business risk. Companies with strong brand recognition face less competitive pressure and maintain more stable market positions during economic uncertainty.

Investors typically assign lower risk premiums to companies with strong brand moats, resulting in higher stock valuations. The predictability of branded businesses makes them attractive investments, particularly in volatile market conditions.

Growth Narrative and Strategic Vision

Marketing strategies that communicate clear growth narratives help investors understand a company’s strategic direction and growth potential. Companies that effectively articulate their vision through marketing often receive higher valuations based on their perceived ability to execute strategic initiatives.

The most successful companies align their marketing messages with their strategic business objectives, creating coherent narratives that both consumers and investors find compelling.

Measuring Marketing’s Impact on Stock Performance

Brand Valuation Metrics

Several metrics help quantify how marketing contributes to stock performance. Brand value assessments, customer acquisition costs, and lifetime value calculations provide insights into the financial returns generated by marketing investments.

Companies can track the correlation between marketing campaign performance and stock price movements to understand which strategies generate the strongest investor responses. This data helps optimize marketing strategies for both customer and investor impact.

Customer Metrics That Investors Track

Investors closely monitor customer-related metrics that reflect marketing effectiveness. Net Promoter Scores, customer retention rates, and market share data provide insights into brand strength and competitive positioning.

Companies that consistently report improving customer metrics often see positive stock price reactions as investors interpret these trends as indicators of future financial performance.

Financial Performance Indicators

The ultimate measure of marketing’s impact on stock prices comes through financial performance metrics. Revenue growth, profit margins, and return on marketing investment demonstrate the financial returns generated by marketing strategies.

Successful companies establish clear connections between their marketing investments and financial outcomes, helping investors understand the value creation process.

Industry Examples of Marketing-Driven Valuations

Technology Sector Leadership

Technology companies often receive premium valuations based on their ability to communicate innovation and market leadership through marketing. Companies like Microsoft, Google, and Amazon have built substantial market values partly through marketing strategies that position them as industry leaders.

These companies excel at translating complex technical capabilities into compelling market narratives that both consumers and investors understand and value.

Consumer Brand Premiums

Consumer goods companies demonstrate clear connections between marketing effectiveness and stock performance. Companies like Coca-Cola, Procter & Gamble, and Unilever maintain premium valuations based on their portfolio of strong brands built through decades of marketing investment.

Their success shows how consistent marketing investment creates enduring competitive advantages that investors recognize and reward with higher valuations.

Retail and E-commerce Success

Retail companies have shown how effective marketing can drive both customer acquisition and stock performance. Companies like Amazon, Shopify, and newer entrants like Warby Parker have used marketing to build strong market positions that translate into attractive valuations.

Their strategies demonstrate how marketing can create sustainable competitive advantages even in highly competitive retail environments.

The Role of Product Marketing in Investor Perception

A common product marketing technique involves creating differentiated positioning that highlights innovation, customer benefit, and long-term value. Investors interpret this clarity as a sign of strategic focus, which can strengthen market valuation.

Key factors investors look for:

- Clear product-market fit

- Consistent brand message across channels

- Visible customer advocacy

| Technique | Investor Signal |

|---|---|

| Unique Product Positioning | Long-term growth potential |

| Customer Testimonials | Brand credibility |

| Data-Driven Campaigns | Strategic discipline |

Diversity and Its Game-Changing Impact on Brand Value

Modern investors increasingly value diversity game changing impact in marketing strategies. Brands that reflect inclusivity and social awareness attract wider audiences and enjoy stronger reputational capital — both of which influence stock prices.

Benefits of diversity in marketing:

- Expands target audience reach

- Enhances brand authenticity

- Strengthens investor trust

| Aspect | Outcome |

|---|---|

| Inclusive Representation | Positive market sentiment |

| Diverse Leadership Teams | Higher innovation credibility |

| Social Responsibility Campaigns | Increased investor appeal |

Outbound Marketing and Market Confidence

Understanding what is outbound product marketing helps companies balance short-term sales activation with long-term brand equity. When outbound campaigns align with corporate strategy, they boost visibility, signal growth intent, and attract investor optimism.

Effective outbound marketing strategies include:

- Personalized outreach to high-value audiences

- Consistent storytelling across media

- Clear communication of market vision

| Outbound Focus | Investor Impact |

|---|---|

| Targeted Campaigns | Increased market confidence |

| Strategic Partnerships | Broader investor interest |

| Brand Consistency | Long-term valuation stability |

How Marketing Strategies Influence Stock Prices

Effective marketing strategies can directly impact stock prices by enhancing brand reputation, increasing sales, and attracting investor confidence. Positive campaigns drive market perception and demand, while poor marketing or public backlash can reduce trust, weaken brand value, and negatively affect stock performance.

Stock prices reflect more than quarterly earnings and balance sheets. Marketing strategies play a crucial role in shaping investor confidence and driving brand-driven valuations. Understanding this connection can help executives make strategic decisions that benefit both customers and shareholders.

The relationship between marketing and stock performance has become increasingly evident as companies like Tesla, Apple, and Nike demonstrate how strong brand strategies translate into market premiums. Their success reveals that effective marketing doesn’t just drive sales—it creates intangible value that investors recognize and reward.

This post examines how different marketing approaches impact stock valuations, the mechanisms behind brand-driven pricing, and strategies companies can use to build market value through marketing excellence.

Building Marketing Strategies for Stock Performance

Aligning Marketing with Business Strategy

The most effective approach involves aligning marketing strategies with overall business objectives and communicating this alignment to investors. Companies should develop marketing strategies that support their strategic vision while creating measurable value for shareholders.

This alignment ensures that marketing investments contribute to long-term value creation rather than short-term promotional activities that don’t build sustainable competitive advantages.

Communicating Value to Investors

Companies must effectively communicate how their marketing strategies create shareholder value. This involves explaining the connection between marketing investments and financial returns, demonstrating the sustainability of marketing-driven competitive advantages.

Regular communication about marketing performance and its impact on business metrics helps investors understand and value marketing contributions to company performance.

Long-term Brand Building

The most successful companies take long-term approaches to brand building that create sustainable competitive advantages. Short-term promotional activities rarely create lasting value for investors, while consistent brand-building efforts compound over time.

Companies should balance short-term marketing tactics with long-term brand-building strategies that create enduring competitive advantages and sustainable value creation.

Maximizing Marketing’s Contribution to Market Value

Marketing strategies significantly influence stock prices through their impact on brand equity, competitive positioning, and growth prospects. Companies that understand this connection can develop marketing approaches that create value for both customers and shareholders.

The key lies in developing marketing strategies that build sustainable competitive advantages while clearly communicating the value creation process to investors. Companies that excel at both brand building and investor communication often achieve premium valuations that reflect their marketing-driven competitive advantages.

Success requires viewing marketing not as a cost center but as a strategic investment that creates measurable shareholder value. Companies that master this approach often find that their marketing excellence becomes a significant driver of long-term stock performance and market leadership.

Frequently Asked Questions (FAQ)

Learn more about: Why Outbound Marketing Fails Without a Strong Online Reputation