Predictive Engagement: Reaching Buyers When Signals Fade

Outbound marketing isn’t ending but evolving. As privacy laws tighten and buyers grow more selective, traditional tactics lose impact. This blog explores how businesses can adapt through personalization, automation, and Predictive Engagement — blending technology with authenticity to build trust, uncover hidden buyer intent, and stay competitive in the modern marketing landscape.

Sales teams are facing a new reality — traditional buying signals are disappearing. Email opens have stagnated, website visits fluctuate, and buyers now research privately using tools that conceal their activity. With fewer visible indicators of intent, conventional engagement metrics like clicks and page views no longer reveal true readiness. To stay effective, modern sales organizations are adopting intelligence-driven strategies that uncover hidden insights and enable meaningful engagement in data-scarce environments.

The New Buyer Behavior Reality

Today’s purchasing decisions happen in corporate conference rooms and private messaging apps rather than on vendor websites. Buyers deliberately avoid leaving traces that might trigger unwanted sales outreach during their research phases.

Committee-based buying processes further complicate signal detection. Multiple stakeholders research independently, share findings privately, and coordinate decisions through internal meetings that vendors never see.

Economic uncertainty has extended evaluation timelines significantly. Buyers spend months researching options without engaging vendors directly, preferring to gather complete information before initiating contact.

Privacy regulations and browser security updates have eliminated many traditional tracking methods. Third-party cookies disappear while email clients increasingly block read receipts and link tracking.

The rise of peer networks and industry forums means buyers access detailed product information through channels that bypass vendor marketing entirely. Professional communities provide unfiltered insights that buyers trust more than official marketing materials.

Building Intelligence Through Relationship Networks

Success in this new environment requires developing human intelligence networks that function independently of digital tracking systems. These relationships provide insights that technology cannot capture.

Industry connections offer early warning systems for market changes and customer needs. Trade association members, conference speakers, and industry analysts often possess information about customer plans before formal requirements emerge.

Partner ecosystems provide visibility into customer activities across multiple vendor relationships. System integrators, consultants, and channel partners frequently understand customer priorities better than direct vendors.

Customer advisory boards and user communities create natural intelligence gathering opportunities. Active participants often reveal organizational challenges and priorities during informal discussions.

Professional development activities indicate individual priorities that typically align with organizational needs. Certification programs, training attendance, and conference participation suggest technology adoption plans.

Former employees who maintain relationships with previous organizations can provide valuable context about internal processes and decision-making patterns. These connections offer insights into cultural factors that influence purchasing behavior.

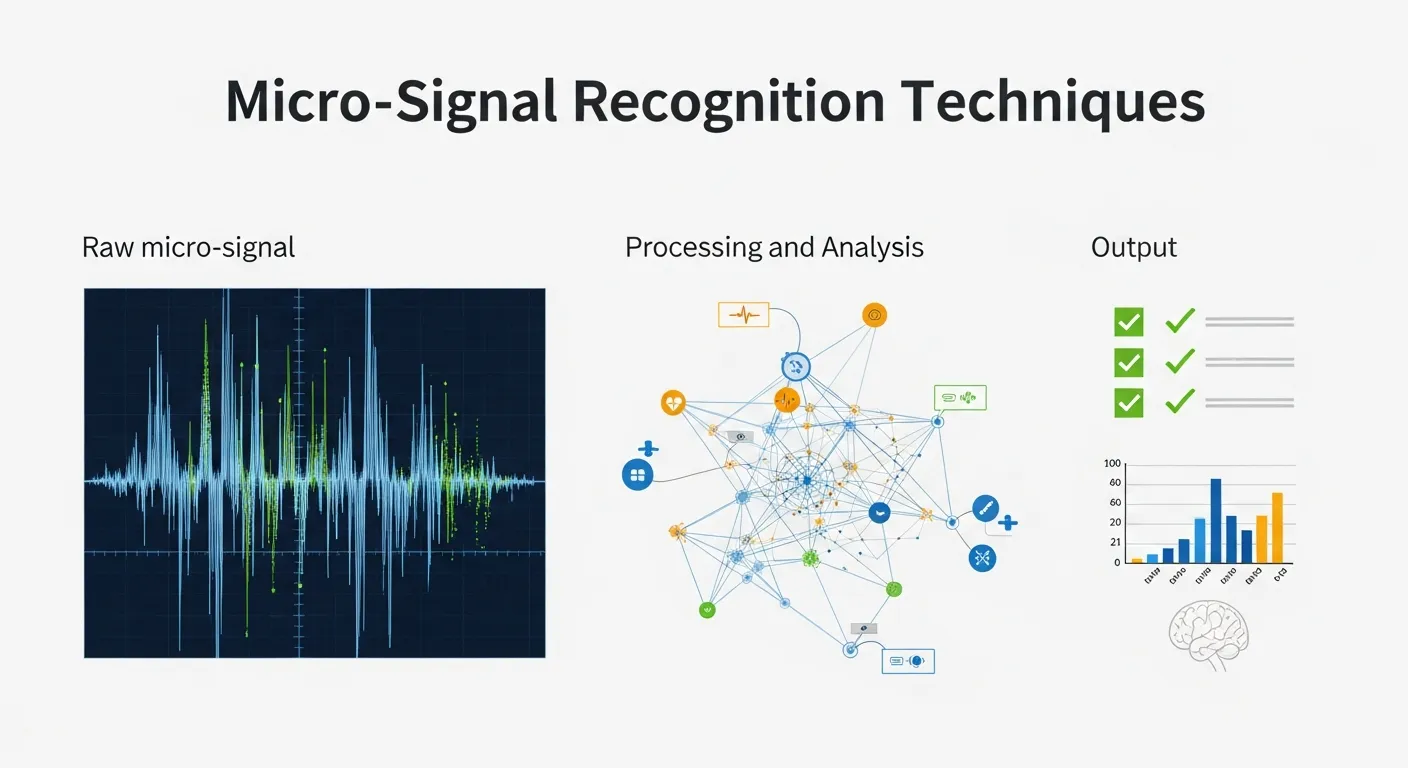

Micro-Signal Recognition Techniques

Effective predictive engagement depends on identifying subtle behavioral changes that precede traditional buying indicators. These micro-signals often appear weeks or months before conventional metrics show increased activity.

Organizational announcements frequently reveal changing priorities before formal solution requirements emerge. Leadership changes, strategic initiatives, and restructuring activities create needs that proactive vendors can anticipate.

Communication pattern shifts indicate evolving internal processes. Changes in response times, meeting participants, and preferred communication channels suggest shifting decision-making dynamics.

Budget cycle awareness enables timing predictions for purchasing activity. Understanding fiscal calendars and planning processes helps identify when dormant prospects may suddenly become active.

Technology environment changes create solution needs that customers may not immediately recognize. Platform migrations, security incidents, and compliance requirements generate opportunities for prepared vendors.

Competitive landscape monitoring reveals market movements that affect customer behavior. Understanding when competitors win or lose major deals provides context for your own prospect engagement strategies.

Contextual Engagement Frameworks

Predictive engagement succeeds by understanding broader business contexts that influence customer decision-making. These frameworks anticipate needs based on industry trends and organizational circumstances rather than individual behavioral signals.

Market condition analysis helps identify when external factors create solution requirements within customer organizations. Economic pressures, regulatory changes, and competitive dynamics generate predictable need patterns.

Industry lifecycle understanding reveals common challenges that organizations face at different growth stages. Startup scaling requirements, enterprise optimization needs, and transformation initiatives create distinct engagement opportunities.

Seasonal business patterns influence purchasing priorities across different sectors. Understanding these cycles helps maintain appropriate communication frequency and messaging relevance throughout extended sales processes.

Crisis preparedness enables responsive engagement when unexpected events accelerate customer decision-making. Natural disasters, security breaches, and regulatory changes often compress evaluation timelines dramatically.

Merger and acquisition activity creates immediate solution needs as organizations integrate systems and processes. Monitoring corporate development announcements provides early indicators of upcoming projects.

Technology-Enhanced Pattern Detection

Advanced analytics platforms excel at identifying engagement patterns across multiple touchpoints and extended timeframes. These systems find correlations that human observers might miss in complex customer journeys.

Cross-channel behavior analysis reveals customer intent through combined activity patterns rather than individual signal strength. Prospects may reduce activity in one channel while increasing engagement through others.

Network effect modeling identifies how customer organizations influence each other’s purchasing decisions. Understanding these influence patterns helps predict when dormant prospects may become active due to peer organization activities.

Timing pattern recognition discovers cyclical behaviors that suggest optimal engagement windows. Historical analysis reveals when prospects typically research solutions, enabling proactive outreach during likely active periods.

Content consumption velocity tracking identifies when research acceleration or deceleration occurs. These changes often indicate internal process shifts that affect purchasing urgency and decision-making authority.

Competitive intelligence integration provides context for customer behavior changes. Understanding competitor activities helps explain prospect engagement patterns and timing variations.

Value-First Communication Strategies

Maintaining customer attention during signal-dark periods requires shifting from direct sales messaging to educational value delivery. These approaches preserve relationship momentum while respecting customer preferences for reduced vendor interaction.

Industry insight sharing positions your organization as a trusted advisor rather than another vendor seeking attention. Research findings, trend analysis, and best practice documentation maintain relevance during customer research phases.

Collaborative planning discussions help customers envision solution benefits and implementation approaches. These forward-looking conversations maintain engagement while providing valuable insights into customer priorities.

Educational content syndication through neutral third-party channels enables continued customer development without requiring direct interaction. Industry publications and professional networks provide valuable distribution alternatives.

For comprehensive approaches to modern customer engagement challenges, platforms like Outbound Marketo offer proven frameworks for navigating complex sales environments and maintaining relationship momentum.

Thought leadership development establishes credibility that supports engagement during extended evaluation periods. Speaking engagements, research publications, and advisory positions maintain visibility without creating sales pressure.

Proactive Account Development Models

Long-term customer relationship investment strategies treat major prospects as multi-year development opportunities rather than quarterly sales targets. This perspective enables sustained engagement through multiple buying cycles and organizational changes.

Strategic account mapping identifies all stakeholders and influence networks within target organizations. Understanding these relationships enables more effective engagement regardless of individual signal strength.

Collaborative value creation projects provide natural engagement opportunities that feel consultative rather than sales-focused. Joint research initiatives, pilot programs, and strategic planning sessions build relationships while demonstrating capabilities.

Customer success story development showcases relevant implementations without direct selling. Case studies and reference conversations provide valuable content while maintaining prospect engagement.

Industry community building creates neutral venues for ongoing customer interaction. User groups, advisory panels, and professional development programs foster relationships without explicit purchasing pressure.

Measuring Relationship Development Progress

Predictive engagement measurement requires metrics that capture relationship quality and development trajectory rather than traditional activity-based indicators. These measurements provide insight into long-term customer potential.

Relationship depth assessment evaluates customer willingness to engage in strategic discussions and collaborative activities. These qualitative indicators often predict purchasing likelihood more accurately than behavioral metrics.

Influence network expansion tracks your organization’s connection development within target accounts. Broader relationship networks typically correlate with higher win rates and shorter sales cycles.

Customer advocacy indicators measure satisfaction and reference willingness among existing clients. Strong advocacy typically precedes referral generation and competitive displacement opportunities.

Competitive positioning strength evaluates your standing relative to incumbent vendors and alternative solutions. This assessment helps prioritize engagement investment and strategy development.

Long-term pipeline contribution analysis reveals whether predictive engagement strategies successfully identify and develop high-value opportunities. This perspective justifies investment in extended development cycles.

Sustained Engagement Through Extended Cycles

Maintaining meaningful customer relationships during signal-sparse periods requires disciplined communication strategies that provide value without creating sales pressure. These approaches preserve positioning while respecting customer autonomy.

Content calendar development ensures consistent value delivery without overwhelming prospects with excessive communication. Strategic timing and relevant messaging maintain attention without triggering avoidance behaviors.

Community participation creates natural interaction opportunities that feel collaborative rather than sales-focused. Industry forums, professional associations, and user groups provide neutral engagement venues.

Patience combined with persistent value delivery builds trust and credibility that eventually translates into purchasing consideration. This long-term perspective enables relationship investment that competitors often cannot match.

Predictive engagement requires accepting that modern customer relationships develop over extended timeframes with limited visibility into internal decision-making processes. Organizations that master relationship intelligence and contextual awareness maintain competitive advantages even when traditional tracking methods provide minimal insight into customer purchasing intent.

Integrating Predictive Engagement Into Product Marketing

Predictive engagement isn’t just for sales — it’s becoming a common product marketing technique used to understand audience intent before launch. By analyzing subtle behavioral data, product marketing teams can anticipate interest levels, tailor messaging, and align campaigns with real market needs.

This approach bridges the gap between product readiness and buyer readiness, ensuring that marketing efforts hit at the right time with the right message.

Benefits of Predictive Engagement in Product Marketing:

| Benefit | Description |

|---|---|

| Pre-launch insights | Identify early interest signals to refine messaging before product release. |

| Personalized campaigns | Target different buyer personas based on predictive analytics. |

| Optimized timing | Launch campaigns when engagement likelihood is highest. |

| Reduced waste | Focus on high-intent audiences, improving ROI. |

Predictive engagement turns passive data into actionable intelligence, making it a vital element in modern outbound marketing strategies.

Predictive Engagement in Product Launch Planning

In today’s data-driven marketing landscape, outbound marketing should be part of every product launch plan — but with a predictive twist. Traditional outbound relies on timing and volume, while predictive engagement adds precision and personalization.

To integrate predictive engagement effectively:

- Combine intent data with historical trends – Use analytics to forecast interest spikes before launch.

- Align marketing and sales timing – Coordinate campaigns with buyer readiness signals.

- Automate early outreach – Use AI to detect when prospects begin pre-launch research.

- Prioritize high-likelihood segments – Direct outbound resources to the most promising leads.

| Stage | Predictive Action | Outbound Alignment |

|---|---|---|

| Pre-Launch | Identify early indicators of buyer curiosity | Build awareness with personalized messaging |

| Launch Phase | Track engagement velocity | Adjust outreach timing and frequency |

| Post-Launch | Measure retention indicators | Strengthen relationships with education-based follow-up |

Predictive engagement enhances every phase of a launch, ensuring outbound efforts are guided by insight rather than assumption.

The Role of Outbound Marketing in Predictive Frameworks

Understanding what is outbound product marketing is crucial to mastering predictive engagement. Outbound product marketing involves reaching potential buyers proactively — through channels like email, events, and targeted advertising — to introduce products, educate audiences, and build early demand.

When paired with predictive analytics, outbound product marketing becomes far more efficient and customer-focused.

Key Elements of Predictive Outbound Product Marketing:

- Data-driven targeting: Focus on accounts most likely to engage based on predictive models.

- Dynamic content: Adjust messaging based on behavior changes over time.

- Cross-channel consistency: Maintain a unified experience across email, social, and events.

- Feedback loops: Continuously refine outbound strategy with performance data.

| Predictive Component | Outbound Application | Outcome |

|---|---|---|

| Buyer intent modeling | Refine target list accuracy | Higher conversion rates |

| Content performance tracking | Optimize outbound messaging | Improved engagement quality |

| Behavior trend detection | Predict campaign timing | Faster response cycles |

When predictive engagement powers outbound marketing, organizations achieve sustained relevance and resonance — even when buyer signals fade.

Frequently Asked Questions (FAQ): Predictive Engagement and Modern Outbound Marketing

1. What is Predictive Engagement in marketing?

Predictive Engagement is the practice of using data analytics, behavioral insights, and contextual intelligence to anticipate when and how to engage potential customers. Instead of relying solely on visible signals like clicks or form fills, predictive engagement analyzes subtle patterns — such as timing, content interactions, and organizational changes — to identify hidden buying intent. This approach helps marketers and sales teams personalize outreach, build trust, and maintain relevance even when traditional signals fade.

2. How does Predictive Engagement differ from traditional outbound marketing?

Traditional outbound marketing focuses on broad outreach — emails, ads, or calls — directed toward potential customers. Predictive Engagement refines this by using data to target individuals and companies most likely to convert. It shifts outbound from a volume-based model to an intelligence-based model, ensuring that each interaction is timely, relevant, and more likely to generate meaningful results.

3. Why is Predictive Engagement important in today’s privacy-first environment?

As privacy laws tighten and tracking tools like third-party cookies disappear, marketers have less visibility into buyer behavior. Predictive Engagement compensates by combining multiple data sources — such as intent data, relationship intelligence, and market signals — to uncover buyer readiness. This enables companies to stay compliant while still engaging customers effectively through insight-driven personalization.

4. How can Predictive Engagement improve outbound marketing results?

Predictive Engagement enhances outbound marketing by identifying which leads are worth engaging and when. It integrates AI analytics to prioritize prospects showing early-stage signals and helps marketers tailor messages that align with each buyer’s journey. As a result, response rates improve, sales cycles shorten, and customer relationships deepen — all while reducing wasted outreach.

5. What is the role of personalization in Predictive Engagement?

Personalization lies at the heart of Predictive Engagement. By analyzing each buyer’s digital behavior, industry position, and communication preferences, marketers can deliver hyper-relevant messages that feel personal rather than generic. Personalization turns outbound campaigns into relationship-building tools — enhancing trust, credibility, and long-term engagement.

6. How does Predictive Engagement align with product marketing strategies?

Predictive Engagement plays a crucial role in modern product marketing by helping teams understand market readiness and buyer intent before launch. It enables precise targeting, optimized timing, and value-driven communication. Whether you’re refining messaging or planning new product introductions, predictive insights ensure that marketing efforts align with real customer demand.

7. What’s the difference between outbound vs inbound product marketing — and which works best at each stage?

Outbound vs inbound product marketing which works best at each stage depends on your business goals and buyer journey phase.

- Inbound product marketing attracts leads through content, SEO, and educational value — ideal for early-stage awareness.

- Outbound product marketing proactively reaches target audiences through email, ads, and personalized outreach — best for consideration and decision stages.

The most effective strategy combines both: inbound builds credibility, while outbound accelerates engagement once interest is established.

8. Can you use both inbound and outbound marketing together?

Absolutely — in fact, can you use both inbound and outbound marketing together is one of the most common strategic questions in modern marketing. The answer is yes, and it’s often essential. Inbound marketing builds long-term trust and authority, while outbound marketing drives targeted visibility and faster pipeline growth. When combined with Predictive Engagement, the two strategies reinforce each other — inbound attracts interest, and outbound capitalizes on intent when the timing is right.

9. Inbound vs outbound marketing — which strategy is right for your business?

The choice between inbound and outbound depends on your business model, audience behavior, and growth objectives.

If you’re building brand awareness and organic traffic, inbound marketing is ideal. If your goal is rapid market penetration or reaching niche decision-makers, outbound delivers faster results.

That said, inbound vs outbound marketing which strategy is right for your business is often best answered by combining both. Predictive Engagement bridges them, ensuring every outreach — inbound or outbound — aligns with real customer intent.

10. How can businesses measure the success of Predictive Engagement?

Measuring Predictive Engagement involves tracking relationship-based and outcome-based metrics rather than traditional vanity metrics.

Key indicators include:

- Engagement quality: Are prospects interacting meaningfully?

- Conversion velocity: How quickly do engaged leads move through the funnel?

- Account expansion: Are existing relationships deepening over time?

- Forecast accuracy: Does predictive data correctly anticipate buying intent?

These insights help marketing and sales teams refine strategies continuously, improving ROI across both inbound and outbound efforts.